Levolytics Research #14: Expectations for Beginning of 2026

First Chart Free | Edition #14

Introduction

Welcome to the newest edition of Levolytics Research! The home of actionable data. If you enjoy the research, please subscribe and share our work with friends and colleagues, and follow @levolytics + @permabullnino on X, the Everything App.

Special Notes

The Levolytics team is hard at work on getting our charting website up and running for our paid subscribers

Projected launch: January 2026

This will be our only report this week, next week we return back to regular programming

Our Take on the Market

Macro Analysis

Metric Description:

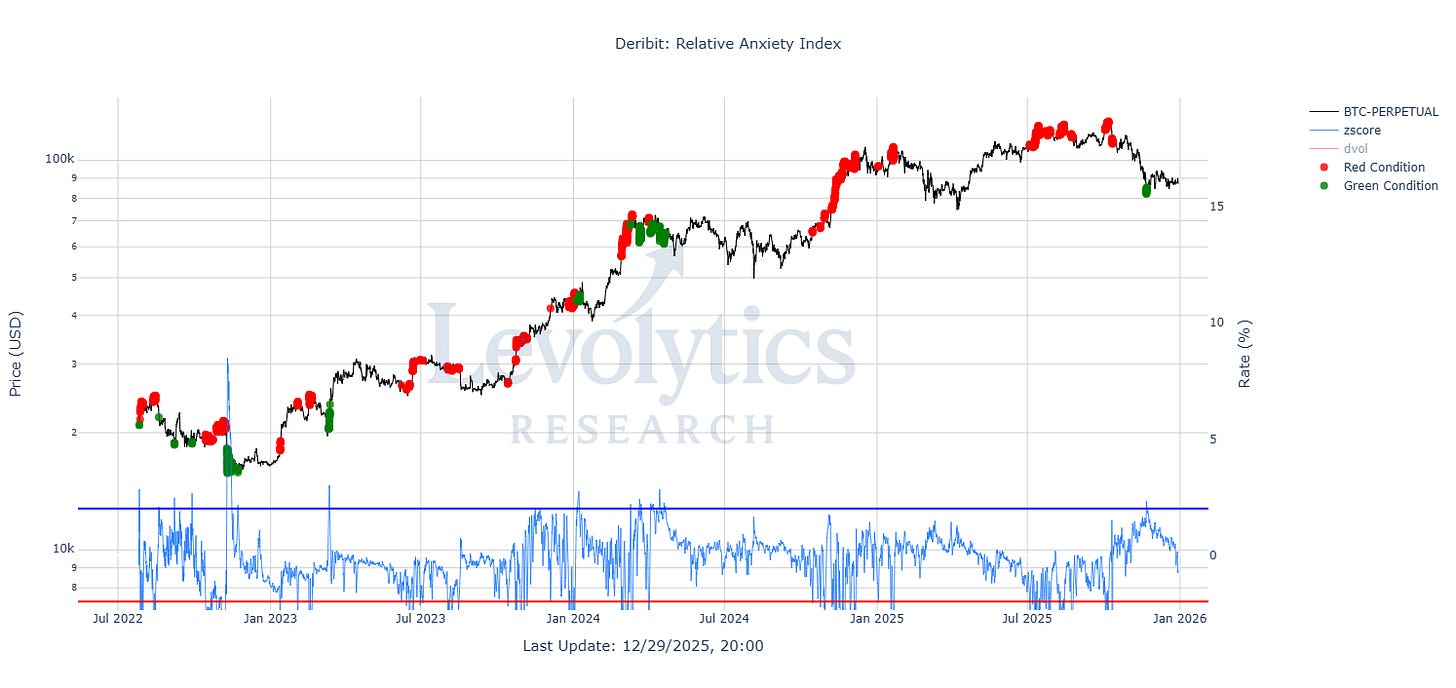

Metric: BTCUSD vs Relative Anxiety Index

Relative Anxiety Index (Blue line) = 200-Day Z-Score of DVOL Minus BTC-PERPETUAL Annualized Funding Rate on Deribit

DVOL = 30 day (forward-looking) annualized expectation of volatility

Red dots = Funding rates are much higher than DVOL

Red dots = very high confidence in the market = values < -2

These generally occur during strong trending conditions or market tops

Green dots = DVOL is much higher than funding rates

Green dots = very high levels of anxiety in the market = values > +2

Most recent green dot = November 21st, 2025

These generally occur during large liquidation events / market bottoms

Current value = -0.77

Note: DVOL & Annualized Funding Rates do not need to be equal. This metric measures the trend and large dislocations from the historical trend.

Metric Takeaway: