Levolytics Research #16: Inching Forward

Edition #16 | Website Update

Welcome to the newest edition of Levolytics Research! The home of actionable data. If you enjoy the research, please subscribe and share our work with friends and colleagues, and follow @levolytics + @permabullnino on X, the Everything App.

Special Notes

The Levolytics team is hard at work on getting our charting website up and running for our paid subscribers

Projected launch: Q1 2026

We are returning to a Tuesday + Friday publication schedule

Our goals moving forward are:

Drive value to paid subscribers via Tuesday long form research + website + Friday report

Provide a preview to free subscribers in Friday Crypto Markets Health Check report

Our Take on the Market

Macro Analysis

Our analysis in the past few months has thematically hit on a handful of messages:

October 10th, 2025 wiped out leverage in crypto to historically low levels

Volatility is back on the menu - which is a good thing

November 21st, 2025 marked a capitulation bottom for crypto markets

There has been no rush to redeploy in size into crypto (as evidenced in the Levolytics % cash positioning)

Our analysis over the past few weeks has shifted in tone, as there are signals that risk taking is returning:

Evidenced in weekly returns

Bullish tilt in options markets

Small pockets of leverage reemerging in perpetual swaps markets

Within, we will continue to explore what we believe is an increasing possibility crypto markets returning to a state of action, leaving the current winter slumber in the rearview.

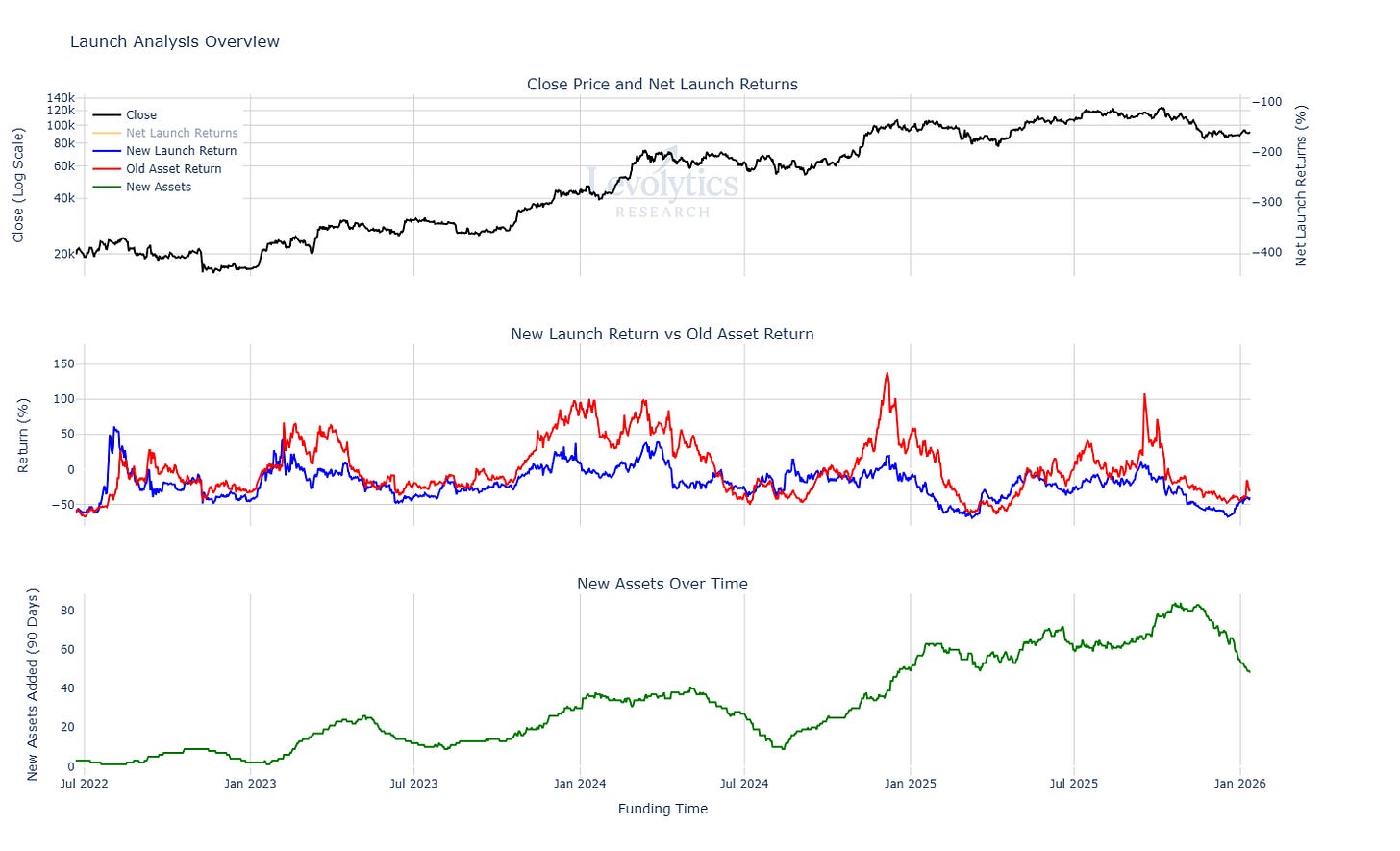

Metric Description:

Metric 1: BTCUSD Price

Metric 2: Average 90-Day % Return for Old Assets on Binance Perps (Red) vs New Assets on Binance Perps (Blue)

Old Assets = -31%

New Assets (< 180 days of trading) = -40%

Old Assets generally outperform New Assets

Metric 3: Rolling 90-Day Sum of New Trading Pairs Added to Binance Perps

Trend is up and to the right, which shows that Binance continues to add new perpetual swap trading pairs at an increasing pace

Current value = 48 new pairs added over past 90 days

New additions slowed in Q4 2025, which historically has coincided with market bottoms

Metric Takeaway: